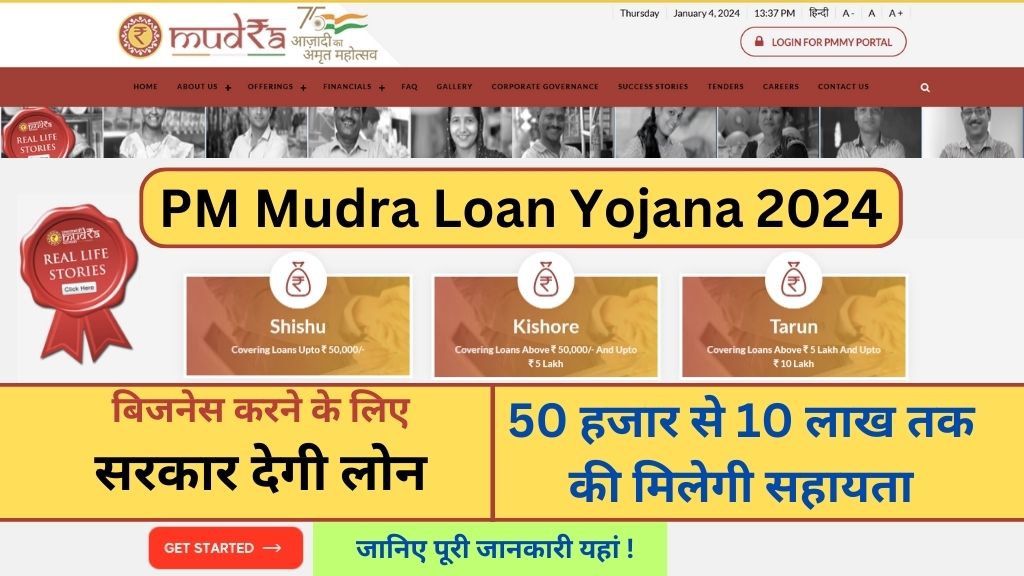

PM Mudra Loan Yojana 2024: If you wish to start your own business but lack the necessary funds, the Central Government has introduced the Mudra Yojana, through which you may obtain a complete loan ranging from 50,000 to 10 lakh. You can acquire a loan of up to Rs. 1000, and so that everyone can profit from this plan, we will go over PM Mudra Loan Yojana 2024 in depth in this post.

The government Is using this initiative to provide low-interest loans from banks to persons in need. If you are an unemployed person who wants to establish your own business but lacks the necessary funds, you may do so by obtaining a loan under this plan. Following that, we will explain how you might profit from the PM Mudra Loan Scheme.

PM MUDRA Loan 2024

If you wish to establish a business or expand an existing one, the government will offer you a loan ranging from Rs 5 lakh to Rs 10 lakh under the Pradhan Mantri Mudra Loan Scheme. The loan from this plan is promptly transferred into your bank account. Which you may utilize to launch or grow your business.

In order to help our young who are unemployed, Prime Minister Shri Narendra Modi has created the Pradhan Mudra Yojana 2024 in 2024. Loans ranging from Rs 50 thousand to Rs 10 lakh are made available to all qualified youth under this initiative. This will aid them in brightening their future and living a better life. This plan is available to qualified women and males over the age of 18. It is important to note that you do not need to have a bank account to participate in this plan.

Low Cibil Score Loan Process 2024 How to get a Personal Loan with low cibil process

SBI E Mudra Loan Apply Online 50,000 Loan, Interest Rate, Online Application, Condition, process

BOB Digital Personal Loan Online apply 2024: Features, Documents required, eligibility criteria

PM Mudra loan online apply

- If you apply for Shishu Loan, you will be granted a loan of 50,000.

- Kishore Loan provides you with loans ranging from 50,000 to 5 lakh.

- If you apply for a Tarun Loan, you will be given a loan ranging from Rs 5 lakh to Rs 10 lakh.

PM Mudra Loan Benefits

- Its objective is to develop and progress the partner organizations.

- Its objective is to create a value-based and sustainable entrepreneurship culture

- One of its objectives is to create an integrated service provider for social development.

- This scheme has been started with the aim of promoting small-scale industries.

- Through Pradhan Mudra Yojana, children have been provided the facility to take a loan of Rs 50,000.

- By getting a loan amount of Rs 10 lakh under the scheme, you can establish a small-scale industrial unit for yourself. PM E MUDRA Loan Apply Online 2024

- In which citizens can start their own employment by taking loans and promoting themselves in the field of employment.

PM Mudra Loan Eligibility Documents

- Aadhaar card

- Pen card

- Bank account

- Address proof

- Income certificate

- Passport size photo

- Mobile number

- Mudra Loan Eligibility

PM Mudra loan eligibility

- All youth should be temporary citizens of India

- Applicants must be above 18 years of age

- You should have a satisfactory plan for self-employment etc.

- Online E Mudra Loan Apply: You can take a loan up to Rs 50,000 sitting at home in just 5 minutes, apply online from here

Pradhan Mantri Mudra Yojana Application Form

- To apply online under the Mudra Loan Scheme, first of all, you have to go to its official website.

- On the home page of this website, you will see the options of Shishu, Tarun, and Kishor.

- Here you have to select whatever type of loan you want.

- After selection, the link to the application form will open in front of you.

- Here you have to download the application form for PM Mudra Loan Scheme by clicking on the download option.

- Now you have to print it out and take out its hard copy.

- After this, you have to fill in all the information asked in this application form correctly.

- After filling in all the information, you will have to attach all the necessary documents with the form.

- After this, you have to take this application form and submit it to your nearest bank.

- Now your form will be scrutinized by the bank in your CIBIL score will also be seen.

- If everything is found correct then you will be approved by the bank for a loan under this scheme.