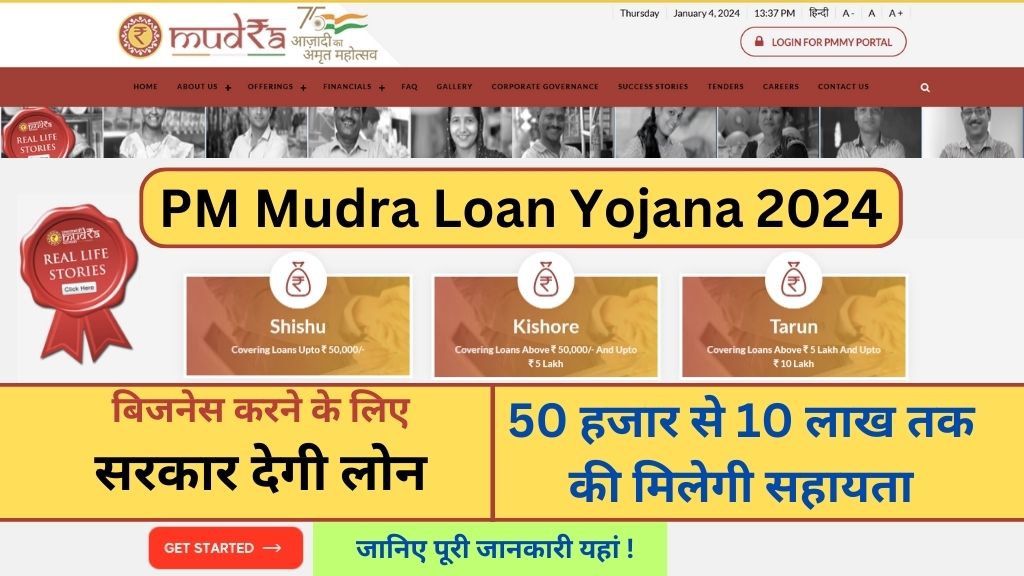

PM Mudra Loan Yojana 2024: If you want to do your own business but have a money problem, then to solve your problem, the Central Government has launched Mudra Yojana, with the help of which you can get a full loan from ₹ 50,000 to ₹ 10 lakh. You can get a loan up to Rs. 1000 and so that all of you can get the benefits of this scheme, we will tell you in detail about PM Mudra Loan Yojana 2024 in this article.

At the same time, let us tell you that to do PM Mudra Loan Yojana 2024, you will need some documents and that is why in this article, we will provide you with the complete list of the required documents so that you can participate in this scheme without any problem. Can apply. Lastly, at the end of the article, we will provide you with quick links so that you can be the first to get all the latest articles under PM Mudra Yojana.

PM Mudra Loan 2024

In this article, we want to warmly welcome all the readers including applicants who want to build their own bright future by doing their own business and that Is why we will tell you in detail about PM Mudra Loan Yojana in Hindi in this article. I will tell you that you will have to read this article carefully so that you can get complete information about this scheme.

Let us tell you that, to apply for PM Mudra Loan Yojana Online, you will have to adopt an online or offline application process and for your convenience, we will provide you information about both application processes so that you can apply for this scheme quickly and Can avail the benefits of this scheme. Finally, at the end of the article, we will provide you with quick links so that you can easily get similar articles and benefit from them.

Google Pay Personal Loan 2024: Eligibility Criteria, Documents Required, Benefits, Apply Online

BOB Digital Personal Loan Online apply 2024: Features, Documents required, eligibility criteria

Low Cibil Score Loan Process 2024 How to get a Personal Loan with low cibil process

Mudra Loan Benefits

- Every unemployed youth or citizen of the country who wants to start their own self-employment can apply for PM Mudra Loan Yojana 2024.

- Under this scheme, all you youth can easily get a loan ranging from ₹ 50,000 to ₹ 10 lakh,

- Under the scheme, you will have to pay nominal interest on the loan.

- With the help of PM Mudra Yojana, all of you youth can ensure your self-reliant development by starting self-employment of your choice and

- In the end, you can build your bright future, etc.

- Finally, in this way, we told you about the benefits including benefits received under this scheme so that you can apply for this scheme and get its benefits.

Pradhan Mantri Mudra Loan Bank List 2024

- Public sector banks

- Private sector banks

- State-Run Cooperative Bank

- Regional Rural Banks

- Institutions offering microfinance

- Financial companies other than banks etc.

Mudra Loan Types

- If you apply under Shishu Loan, you are given a loan of ₹50,000.

- Under Kishore Loan, loans ranging from ₹ 50,000 to ₹ 5 lakh are provided to you.

- If you apply under Tarun Loan, then you are provided a loan ranging from Rs 5 lakh to Rs 10 lakh.

Mudra loan eligibility

- There should be no past loan defaults linked to the applicant.

- Your business must be at least 3 years old.

- Entrepreneurs seeking the loan should be between the ages of 24 and 70.

PM Mudra loan online apply

- To apply online under the Mudra Loan Scheme, first of all, you have to go to its official website.

- On the home page of this website, you will see the options of Shishu, Tarun, and Kishor.

- Here you have to select the option of whatever type of loan you want.

- After selection, the link to the application form will open in front of you.

- Here you have to download the application form for the PM Mudra Loan Scheme by clicking on the download option.

- Now you have to print it out and take out its hard copy.

- After this, now you need to fill out the application form correctly.

- After filling in all the information, you will have to attach all the necessary documents with the form.

- After this, you have to take this application form and submit it to your nearest bank.

- Now your form will be scrutinized by the bank in your CIBIL score will also be seen.

- If everything is found correct then you will be approved by the bank for a loan under this scheme.